Founded in 1993, Tristel utilises its proprietary chlorine dioxide chemistry to manufacture disinfection products. Under the Tristel brand, it targets medical device decontamination, while its ‘Cache’ brand focuses on surface disinfection. Products are squarely aimed at hospitals, specifically departments that use small devices in diagnostic tests and require disinfection before reuse. Its sole manufacturing facility is located in the town of Snailwell, near Cambridge, from which its increasingly global customer base and workforce are managed. Change is afoot, with Paul Swinney, CEO of 30 years and Tristel’s founder, deciding to hang up his boots, to be replaced by Matt Sassone, a veteran of the American healthcare industry.

Chlorine Dioxide (ClO₂): A Scientific Summary

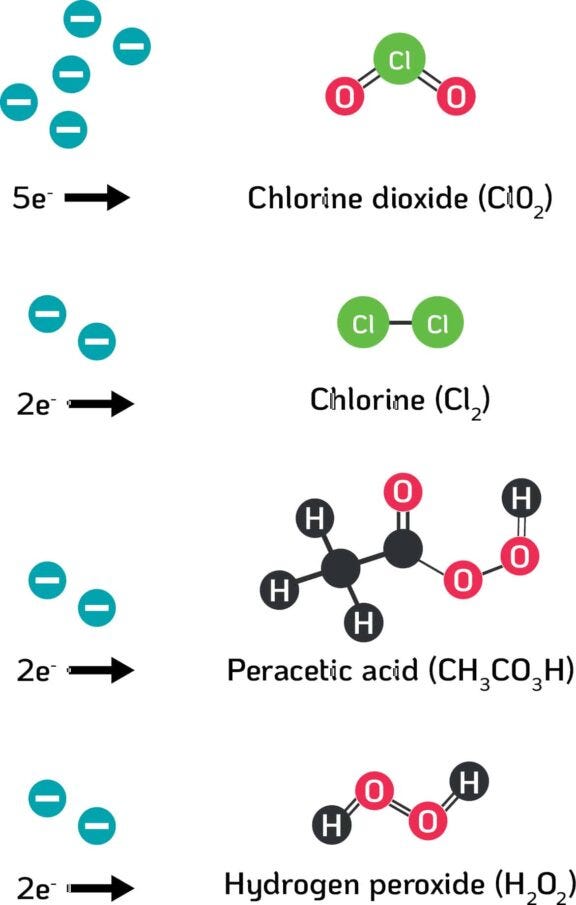

In 1897, the quaint English town of Maidstone became the first place in the world to have its entire water supply treated with chlorine. Since then, water treatment has remained the predominant end use of chlorine dioxide. However, scientific understanding has since expanded, and its effectiveness in destroying pathogens is now widely recognised. ClO₂ is produced by adding citric acid to sodium chlorite. It inactivates and destroys pathogens by pulling electrons from surrounding molecules. Its superiority comes from the number of electrons it can accept, upto five, which compares favourably to competing chemicals.

ClO₂’s mode of action prevents pathogens from developing resistance, and it is also highly selective—targeting specific parts of a cell or virus while preventing damage to surrounding material. Its effectiveness remains high even at low concentrations, reducing chemical exposure for the user.

What Tristel Does

Tristel organises its operations into two main segments:

Medical Device Decontamination - Under the Tristel brand, the company manufactures a range of products used for disinfecting medical devices, with a focus on hospital environments. They aim to capture the widest possible market by ensuring compatibility with medical instruments from most major manufacturers—currently numbering around 2,000 different devices. Some of the products include:

Tristel Trio Wipes System: Used to decontaminate semi-critical medical devices (those that come into contact with mucous membranes, such as those found in the intestines, windpipe, and nose). Applications vary from manometry catheters (stomach and oesophagus) to endocavity probes used in women’s health. It utilises a simple three-step process: pre-clean wipes, followed by sporicidal wipes (onto which foam is added to create chlorine dioxide), and finished with rinse wipes to remove chemical residue.

Tristel DUO OPH: Designed for disinfecting ophthalmic and optometric devices. Tristel DUO Wipes: Used to apply other products; these are sold as complementary items, offering benefits such as low absorption and low linting, enabling better application. Tristel DUO ULT: Focused on disinfecting all parts of an ultrasound transducer, including the computer system, plug, cable, probe, and holder. These devices are commonly used in pregnancy and muscle scans.

Tristel Stella: Provides disinfection for all small, heat-sensitive medical devices with a 5-minute turnaround time. The item is placed inside the machine, and ‘Tristel Clean for Stella’ detergent is added. It compares favourably to more expensive, fully automated washer disinfectors.

Surface Disinfection - Under its Cache brand, Tristel designs and manufactures disinfectants for hospital surfaces. Products include:

JET: Disinfects high-touch points such as doorknobs, bed rails, and light switches. JET LUX: The lightest JET formula, used on sensitive surfaces such as screens and keyboards.

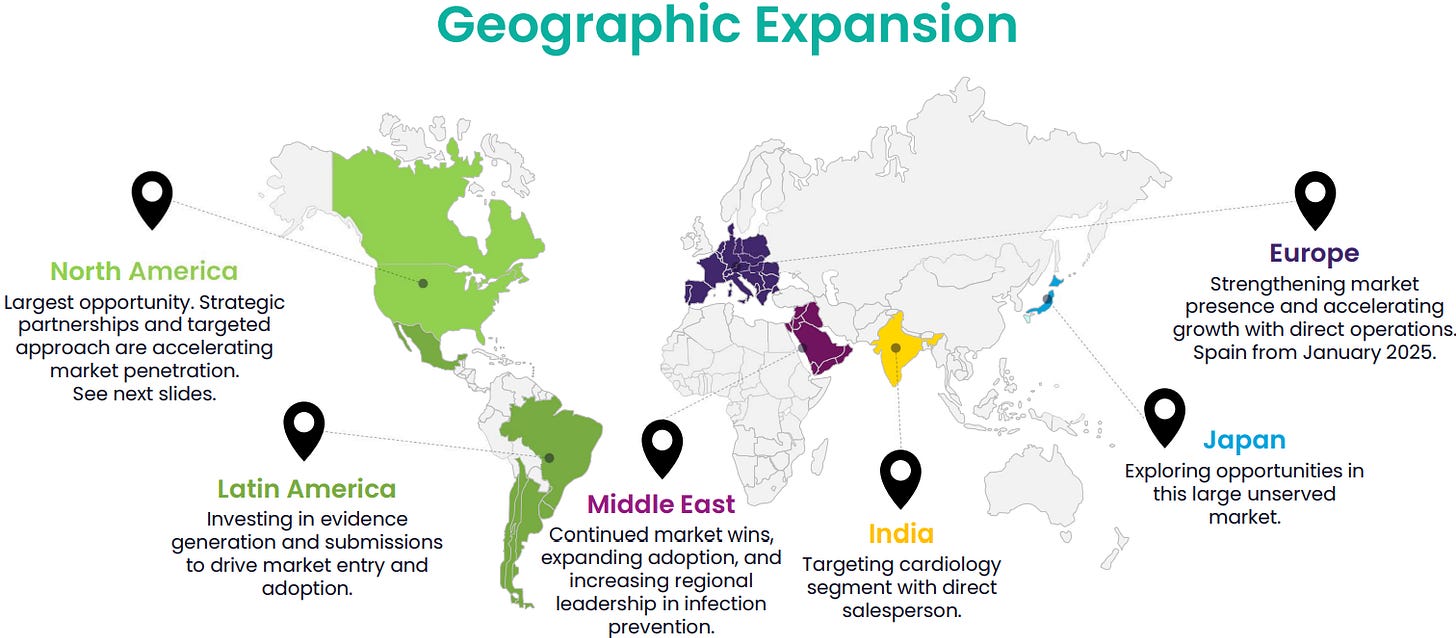

Corporate structure: Tristel operates through 16 subsidiaries, selling directly into hospital markets in the UK, Belgium, the Netherlands, France, Italy, Germany, Switzerland, Poland, Hong Kong, China, Malaysia, Singapore, Australia, New Zealand, and India. The Russian subsidiary closed in early 2022. Several subsidiaries are currently inactive, notably in Spain, Ireland, and Japan. In another 45 countries where no subsidiary exists, Tristel sells through national distributors.

The company has recently introduced a new revenue stream, royalties, through a partnership with Parker Laboratories to supply its products to the vast US healthcare market. A 24% fee is earned on each sale of a product containing Tristel’s proprietary chlorine dioxide chemistry.

Competitive advantage: The firm holds 149 patents across 32 countries, with six more applications pending and three patents granted in 2024. Tristel’s competitive advantage lies in the speed and ease of use of its products. Manual application allows for disinfection at the point of care, significantly reducing turnaround times. In contrast, alternatives involve semi-automated systems requiring both manual and automated cleaning, increasing costs and reducing efficiency—especially as these systems often require water, electricity, and regular maintenance.

By focusing on relationship-building with key gatekeeper, such as regulators, opinion leaders, and authors of clinical guideline, Tristel has established strong barriers to entry. This strategy has led to the company’s inclusion in clinical guidelines bestowing products with scientific endorsement.

Additionally, Tristel products are featured in infection control studies on well-known pathogens such as HPV and SARS-CoV-2 (the virus responsible for COVID-19), strengthening their scientific credibility and regulatory appeal.

Regional & Segmental Analysis

Sales by segment: 87% of sales come from medical device decontamination, 8% from surface disinfection, and the remaining 5% of revenues stem from the pharmaceutical and personal care product manufacturing industries, as well as the veterinary and animal welfare sectors. Trends that have emerged in the last 5 years include the increased importance of the medical device decontamination segment, which has grown from 74% of sales to 87%. This growth has been driven by the post-pandemic return to comprehensive hospital care, which had been suspended during COVID, as resources were funneled into A&E departments. Tristel’s products are focused on small medical devices with diagnostic applications.

Growth by Region/Segment: Revenues grew fastest in the UK & Europe (+20.3%), followed by a modest increase of +1.1% in the rest of the world, while sales fell by -0.4% in the APAC region. The medical device decontamination segment grew the fastest at +18%, being the only revenue stream to post modest growth during the pandemic, while the "other" segment grew by +14%, marking the first revenue growth in 3 years.

Growth Strategy

Expansion into USA: There are currently 6,000 hospitals across America, with 70% in hospital networks. These are favourable conditions for a ‘land & expand’ strategy, with initial product adoption leading to adoption by other hospitals in each network. Hospital sales cycles are 9–18 months, with drawn-out procurement processes further incentivising product adoption by other hospitals in a network. Another customer base includes the 11,000 private clinics, for whom procurement tends to be more impulsive, with the onboarding of 7 clinics in South Carolina and Florida taking only 2 months to purchase. Some other recent examples of successful customer acquisition:

In Boston, the flagship hosptial of a 14-hospital health system adopted Tristel ULT in 2 departments with its use to be broadened across other dpeartments while also expanding it to 4 other hospitals in the group.

While in an Orlando-based health system, Tristel ULT and 3T were implemented in 13 Florida OB/GYN clinics, replacing automated disinfection machines. The sales process took 12 months with value assessment committees taking most of the time, although planned expansion across more loctions makes it worth the wait.

The two most promising applications are ultrasound and ophthalmology:

Tristel products were used in 50,000 ultrasound procedures in H1 25, with a TAM of 50 million procedures, translating to approximately $100m p.a.

The ophthalmology product (Tristel OPH) has just received FDA clearance, with a TAM of 16 million procedures.

To drive product awareness, Tristel attended 8 national and 13 regional tradeshows, and was included in a scientific paper presented at the largest worldwide congregation of urologists.

Product development: The pipeline of products currently includes a training platform application called ‘3T—a Train, Test, and Trace tool’ that assists users in recording all steps of the decontamination process and colour-change technology also aims to assist in this.

Brand focus: For Tristel, management aims to move from “compatible and recommended” to “endorsed and promoted” partnerships with medical device manufacturers. For Cache, the focus is on expansion into underserved markets such as clinical laboratories and A&E services.

Financial Performance

Historical Revenue: Last year, sales grew by 16.4% (£5.9 million), of which £2.7 million was driven by volume increases, while the remaining £3.2 million resulted from an average price increase of 11%, largely due to supply agreements containing fixed future pricing. Volume growth stemmed from international expansion—including entry into new distributor markets, deeper product roll-outs within existing customer sites, and the acquisition of new customers. Since listing in 2005, revenues have grown from £3 million to over £40 million, representing a CAGR of 16%. Management has set financial targets aiming for a rolling 3-year annual average sales increase of 10–15%, an EBITDA margin of at least 25%, and consistent annual growth in pre-tax profit.

Profitability: Tristel leads UK healthcare equipment firms in operating margins (20.6%), return on equity (ROE) at 18.6%, and return on capital employed (ROCE) at 16.7%. Gross margins have gradually increased from 70% in 2015 to 80% in 2024.

Balance Sheet Strength: A current ratio of 3.98 and quick ratio of 3.19 indicate strong liquidity. Cash reserves have grown from £4.2 million to £11.8 million, resulting in negative net gearing of -18%, with total debt remaining around £6 million in recent years.

Capital Allocation: An industry-leading dividend yield of 3.4% reflects management’s policy of distributing at least 50% of adjusted EPS. This has led to a 10-year dividend CAGR exceeding 9%, with dividends rising from 5.7p to 13.5p. A new dividend policy, guaranteeing a minimum annual increase of 5%, has recently been instituted. However, dividend cover has hovered around 1x for each of the last four years, suggesting limited headroom for further increases without earnings growth.

In 2024, 226,500 shares were issued, representing 0.48% of the share capital and raising £676,000.

Valuation

Key assumptions:

FCF/Net Income: 134%

Revenue growth rate: 5% (CAGR for previous 5 years was 9.8%)

Net income margin: 13.55% - excluding the slump in 2022 derived from the inflationary environment

WACC: 5.04%

Based on these assumptions, the resulting fair value per share is £5.84, implying a margin of safety of 41% relative to the current price.

Risks

Customer Concentration: As of 2024, a significant portion of total revenue was earned from a single customer. This concentration has risen steadily from 20.5% in 2020, with the majority of the increase stemming from a sharp rise in the surface disinfection segment, which now relies on one customer for 57% of its revenue—almost double the 23% recorded in 2021. The risks associated with this are clear and likely require no further explanation. However, diversification of the customer base is something management should prioritize.

Regulations: Tristel’s products are primarily used in hospitals, which are highly regulated environments. Approval is required to sell into most countries around the world. Since international expansion is a key focus for the company, Tristel will face competition from local firms that possess a better understanding of the nuances involved in both attaining and maintaining regulatory approval. Additionally, there is a risk that regulators may shift away from chemical disinfectants or their manual application methods.

Future Pandemics / Major Health Crises: Interestingly, 2020 was the only year in the past decade in which revenue declined. One might assume the COVID-19 pandemic would have been a boon for an infection prevention business. However, hospital resources were focused on A&E departments, while outpatient clinics either closed or significantly reduced activity—greatly reducing demand for the decontamination of small medical devices commonly used in diagnostic procedures.

Change in Market Demands: There is a potential risk of a market shift away from manual decontamination systems toward alternative or competing technologies.

More aggressive share dilution

If you found value in this research, consider supporting the work with a coffee:

FYI, there is no way a 5.04% WACC is right for a sub GBP 200mln market cap.. probably at least 10% which completely wipes out your margin of safety.. Tristel looks like an interesting company but just wanted to point that out.