Elixirr International (LON: ELIX)

High Margins, Strong Growth, Founder-Led—And Still Undervalued

When a business averages revenue growth of over 30% annually for a decade, you have to pay attention and take note. Even more so when it’s one of only a handful of publicly listed consulting companies; a sector marked by a 30-year CAGR of >6% and strong margins resulting from strong pricing power.

Elixirr is a relatively young consultancy, founded in 2009 with the stated goal of becoming the best digital, AI and data consultancy in the world anchored on the technology of tomorrow. Yesterday marked a huge milestone, with the company making the leap from AIM to the Main Market with shares popping 6.5%. I was supposed to publish this report before the move but life gets in the way. Enjoy!

Company History

2009-14: After its founding in 2009, Elixirr expanded globally gaining its first US & South African client while revenue growth YoY reached 150% in 2013.

2015-19: Following a rebrand from its original name of Elix-IRR, the firm continued its international expansion by launching its US business. Management commenced its acquisition strategy by purchasing Den Creative whose revenues tripled within 24 months of becoming an Elixirr company.

2020-22: Having grown from 1 partner to 17, Elixirr debuts on the AIM of the London Stock Exchange in 2020 while it acquired 2 more companies. For the first time, completing acquisitions in consecutive years of which iOLAP represented the 1st US and largest acquisition at that point.

2023-24: Elixirr ramps up strategy of growth by acquisitions with 3 companies joining within 2 years. These included Responsum ( specialists in generative AI), Insigniam, pioneers in organisational change and transformation, join the Group. Hypothesis, a research and insights company, joins the Group

Business Model

Although Elixirr reports as a single entity without segmentation of revenues , its operations can be understood through its capability-led business units, each aligned to a distinct service offering, client proposition, and acquisition history.

1. Elixirr Consulting

Key acquisition: Retearn Group

Services Offered: Market strategy development, refining competitive positioning, improving the business model, M&A, bolstering governance structures and future proofing.

Project examples: Redesigned coaching model to grow talent pool and aid a US sport's governing body’ sport's national expansion.

Examples of clients: Virgin Money & Hitachi.

2. Elixirr Digital

Key acquisitions: Den Creative, Coast Digital and iOLAP.

Services Offered: Customer experience research/design, cloud strategy, migration data strategy development, digital marketing & development.

Project examples: Redesigned Chipotle’s menu to better cater to a younger customer base.

Examples of clients: United States Tennis Association and pet nutrition giant Royal Canin.

3. Elixirr AI

Key acquisition: Responsum

Services Offered: AI implementation, strategy and automation. AI decision models and AI Customer Assistance.

Project examples: Development of AI platform for image analysis in stroke risk detection.

Examples of clients: Aztec Group & Associated Bank.

4. Insigniam (Change & Leadership)

Key acquisition: Insigniam

Services Offered: Organisational culture change, leadership development, strategy execution and driving breakthrough change.

Project examples: Worked with a major food company to increase sales by 7% in one year through shifts in mindset, performance culture and leadership alignment.

Examples of clients: McCain and Johnson & Johnson.

5. Hypothesis (Insights & Research)

Key acquisition: Hypothesis

Services Offered: Comprehensive Research, Advanced Analytics, Customer insights, and strategic brand positioning.

Project examples: Aided marketing and naming of a new professional hockey team in a major sports league to create an attractive brand to fans.

Examples of clients: Apple & Pepsi.

Management: Both the CEO Stephen Newton and Deputy CEO Graham Busby are Co-Founders. Stephen has over 25 years of consulting experience having previously worked at both of Elixirr’s main competitors, IBM and Accenture. Similarly, Graham worked for Accenture as a memeber of a team responsible for selling and shaping transformational deals worth over $500mn.

Regional/Segmental Analysis

Sales by Region: During 2024, US-derived sales surpassed the 50% mark having more than doubled since 2020, driven in large part by US-based acquisitions of iOLAP, Hypothesis and Insigniam. Although this may stem from US dominance in the global consulting market with a current market share of 40%.

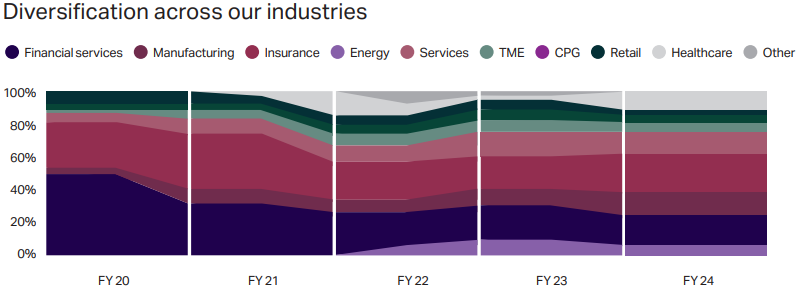

Revenue by industry: Although the firm doesn’t breakdown revenues by service line, it does segment revenues by industry. As you can see below, Elixirr has become less reliant on business from Financial Services and Insurance having halved since 2020 from 80% to 40%.

Growth

Increasing partner productivity - Per partner revenues rose 6% for FY24 to £4.1mn with the number of clients generating over £1mn in sales increasing from 19 to 27 YoY. Measures such as strategic rate cards, strategic client relationship management and a robust partner incentivisation model are used to extract more from partners.

Hiring new partners: Partners currently number 36, an increase of 7 since Elixirr’s 2020 IPO. The recruitment strategy focuses on finding individuals with a wealth of industry experience both in current expertise and areas into which the firm wants to expand. Each hire brings their network through which clients can be introduced to Elixirr’s services. Examples of 2024 hires include Nick Billington, a veteran of the financial services industry, who has held leadership positions at Accenture, KPMG and Capita. Meanwhile, underperforming partners are ‘phased out’.

Promoting partners: Cultural fit is an important aspect of recruitment at any level in any business. Given this risk, management have a long term commitment to hiring from within labelling this policy ‘grow your own timber’. FY24 saw the first promotion to Partner from an acquired business (iOLAP) and, more recently in January 2025, 3 Principals were promoted to Partners.

Acquisitions:

Since 2017, Elixirr has acquired 7 businesses with management targeting 1-2 high quality acquisitions annually; those that could contribute to 10-20% of Elixirr’s enterprise value. The focus is on US & Europe-based firms whose capabilities are either complementary or in-demand. To achieve this, the dedicated M&A team sifted through 1,200 potentials with 17% engaged culminating in 6 offers. Here’s a quick overview of Elixirr’s acquisition history:

Financial Performance

Revenues: Last year revenues rose 29.6% marking the 7th consecutive year of revenue growth with revenues growing 7.5x in that time. The 2024 increase of £25.4mn is broken down neatly below:

Customer concentration has been falling since 2020 when the top 5 clients constituted 52% of sales expanding this to the top 10 clients increased the share to 80% of sales. However by 2024, the top 5 clients contributed to 29% of sales while the top 10 clients equalled 43%.

Profitability: When compared to Booze Allen, IBM and Accenture, Elixirr’s 21.3% operating margin stands out with operating profits up 266% on 2020 levels. ROE and ROCE of 13% and 16.6% rank less favourably to competitors. All of these metrics have stabilised since 2020 showing minimal growth. Last year Elixirr was the only publicly listed consulting company to achieve the rule of 40 & 50; a metric orginating from the venture capital and Saas industry. Only a few firms have achieved this benchmark including Salesforce, Apple, Microsoft, Adobe and Google.

Balance Sheet Strength: The liquidity picture is mixed with net gearing at -2% and both current/quick ratio at 0.8. Cash reserves more than halved to £7.5mn with some of its debt fully repaid and acquisitions financed.

Capital allocation: Dividend yields stood at a middling 3% with a total of £5.5mn paid out to shareholders resulting in a 34% payout ratio. Share Dilutions have been a regular occurrence with a 1-2% increase in share count annually, although a £45.0 million revolving credit facility with NatWest has been agreed which should restrain the urge for more dilutions.

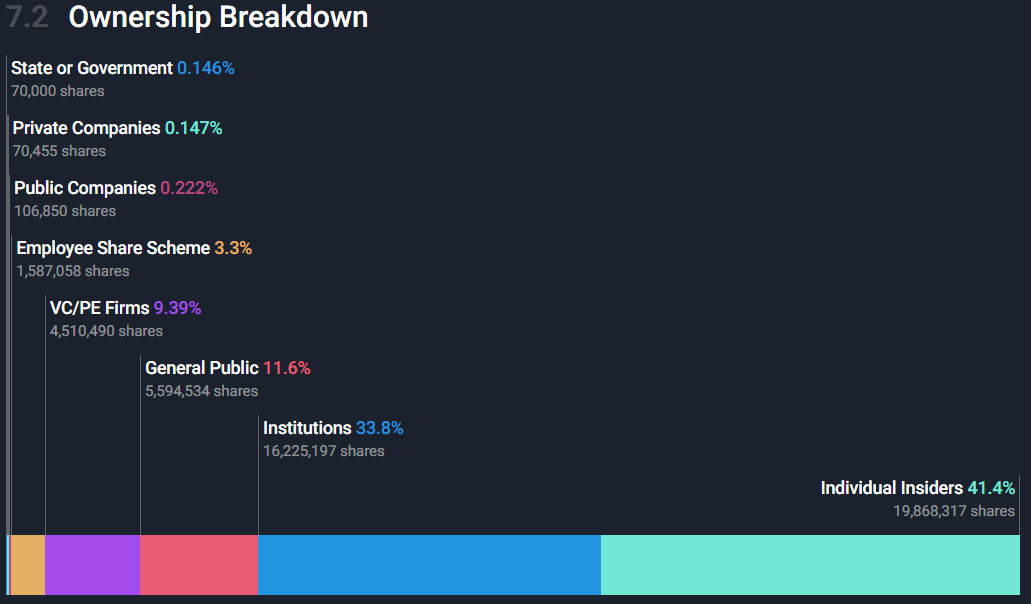

Ownership: CEO & Founder Stephen Newton owns 23.7% with a further 4.7% held by Co-Founder Ian Ferguson and 3.6% held by Deputy CEO & Co-Founder Graham Busby. Other major shareholders include major asset managers such as Gresham House (9.4%) and Rathbones (5.8%) with Elixirr’s employee benefit trust holding 3%.

Move to main market: This should broaden the pool of investors since many investment entities have investement policies that prohibit the purchase of AIM listed companies. Likewise, it should increase access for some international investors who previously couldn’t invest in Elixirr due its AIM listing and retail investors who perceive the AIM market to be risky. For investors this should translate into high share prices with increased analyst coverage and the potential inclusion in the FTSE 250. I suspect another motivator for the move is the ambitious objective yo become a consulting ‘unicorn’ with market cap surpassing $1bn.

Valuation

Key assumptions:

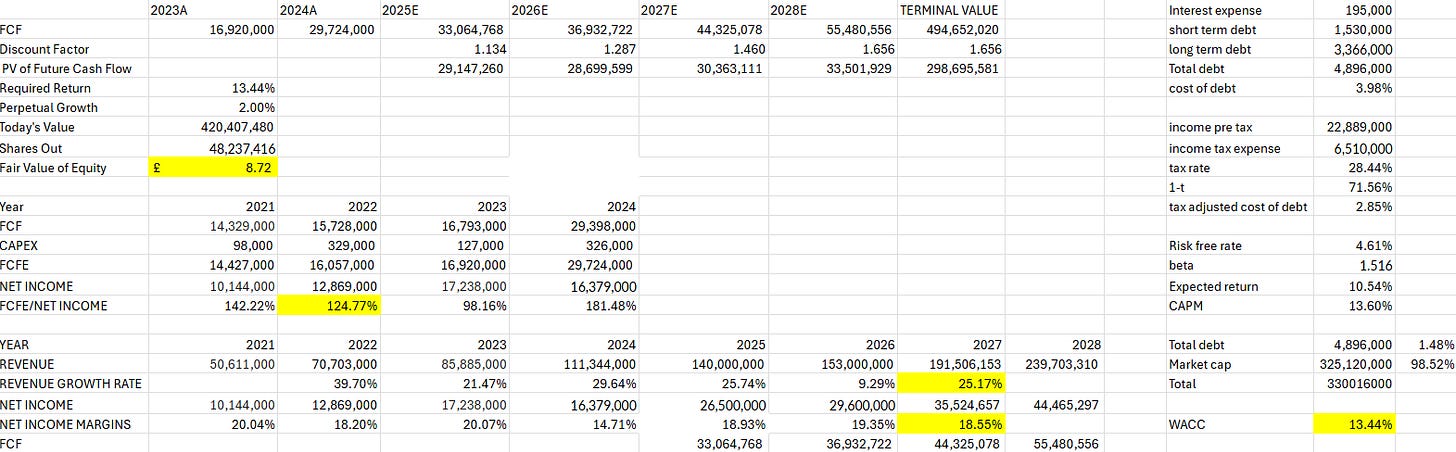

FCF/Net Income: 124.77%

Revenue growth rate: 5% (Average of the previous 5 years, 2 of which derive from analysts expectation)

Net income margin: 18.55%

WACC: 13.44%

Based on these assumptions, the resulting fair value per share is £8.72, implying a margin of safety of 21% relative to the current price.

Risks

Low barriers to entry: Start-up costs are low and differentiation to competitors is not great as services can be replicated by others. Larger firms could expand via aggressive pricing and replicating Elixirr’s sectoral capabilities.

Loss of key clients: Revenues from the largest client were 9.9% of total sales, when expanded to include the top 3 clients this rises to 21.3%. Consulting largely relies on what you last did given the low barrier to entry.

Future dilutions - There are further dilutions planned in the near future and considering the Main market listing, this could incentivise the board to go further knowing they could attract greater interest in any new shares issued.

Talent as a product: The business model essentially relies on selling its employees and their expertise in return for remuneration. Any fall in the quality or availability of new hires and loss of partners could damage the ability to attain or retain clients via a loss in expertise/network.

M&A integration issues