Founded in 2003, Bioventix creates, manufactures, and supplies high-affinity sheep monoclonal antibodies to diagnostic companies that create diagnostic testing kits for their blood testing machines. The company operates from its single facility in Farnham, Surrey, with a workforce of just 17, but that hasn’t held back its financial performance, with revenues tripling since its AIM listing in 2014 and a near five-fold increase in share price. Given this and its favorable valuation, I’m surprised at the lack of coverage.

The science?

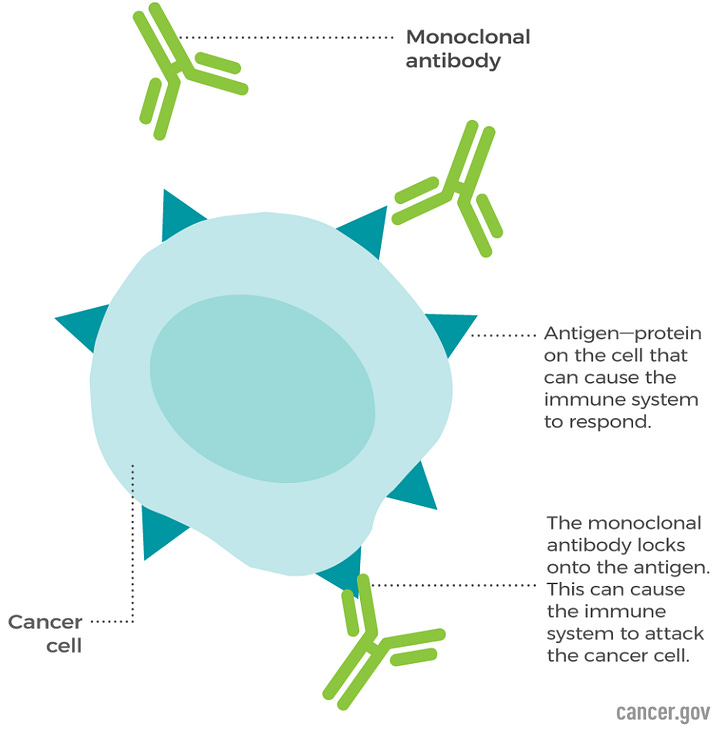

High-affinity sheep monoclonal antibodies (SMAs) are essentially antibodies derived from sheep cells that recognize the foreign target cell. Sheep are injected with the disease, provoking an immune response leading to the production of antibodies, after which blood is extracted. The scientists go through a process of selecting the best antibodies to target the antigens (proteins recognized by antibodies found on the surface of a foreign target cell). It’s important to note that each antibody only attaches to a matching antigen. ‘High affinity’ refers to the ability to bind to a target substance even when it is found at low concentrations, a unique quality of SMAs. This enables greater detection at early stages of disease while they also have a higher specificity in binding to a target, reducing the likelihood of the antibody mistakenly binding to the wrong molecule. SMAs are used for a range of detection purposes, including: fertility, oncology, vitamin D/B, drugs of abuse, Alzheimer's, thyroid, and cardiac.

Business Model

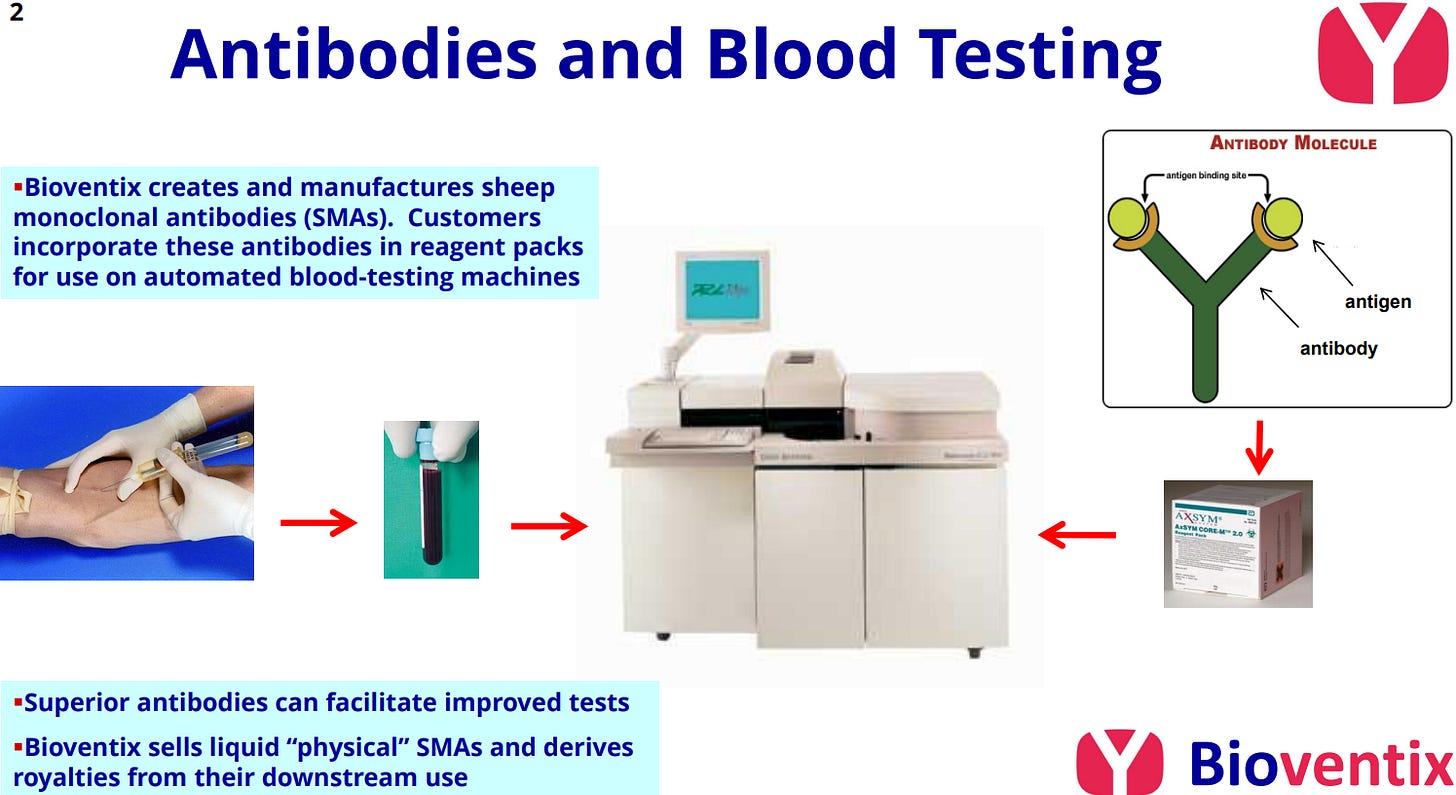

Product: The process from initial creation of an SMA takes approximately a year, after which the product is evaluated in the customer’s laboratory. Subsequently, it goes through the protracted approvals process, culminating in the necessary regulatory certification to commercialize. This takes between 4-10 years, so revenues today are the consequence of innovation from yesteryear. The SMAs are bought by In-Vitro Diagnostic (IVD) companies, including major players such as Abbott Diagnostics, Roche Diagnostics, and Beckman Coulter. These firms input SMAs into testing kits used in their automated blood testing machines for routine clinical use in hospitals. Bioventix differentiates itself by focusing on creating SMAs for targets that don’t have suitable testing kits from traditional monoclonal antibodies. A great example of this was when, in 2005, the company noticed that traditional monoclonal antibodies were insufficient for reporting low levels of testosterone accurately, such as those found in prepubescent boys and women. Interestingly, as women approach menopause, testosterone levels decline, falling more precipitously post-menopause, creating problems around libido, tiredness, difficulty concentrating, and headaches. By 2006, evaluations were taking place in the customer's laboratory, and following the necessary regulatory approvals, the product was launched in 2009.

Commercial approach: These are split into two: 1. Own-risk SMA projects, produced independently, which gives the company free rein to realize commercial potential. 2. Contract SMAs, tailor-made antibodies for individual IVD companies, which ties revenues to that one customer.

Competitive advantage: Time and resources spent to attain regulatory approval is a barrier to entry since any change to the antibody used in the test would, at a minimum, require a partial repeat of the approval process. Therefore, Bioventix’s customers tend to continue using the antibodies, generating the second revenue stream: royalties.

Royalties: Each time a test is taken, a testing pack containing Bioventix’s product is used, generating post-sales revenue for Bioventix. Diagnostics companies sell their testing packs to be used on their automated blood testing machines, through which Bioventix earns a royalty. When I first looked at the stock, I was intrigued as to how it produced an operating margin of over 70%; however, the royalty-focused business model explains that quite clearly since they can continue to make money from historical investments without any additional expenditure. In recent years, royalties have made up a higher percentage of total revenue, rising from 60% in 2020 to 67% in 2024. The product is a shrinking contribution to total revenue, declining from 39% in 2020 to 33% in 2024, which makes the company’s business very scalable.

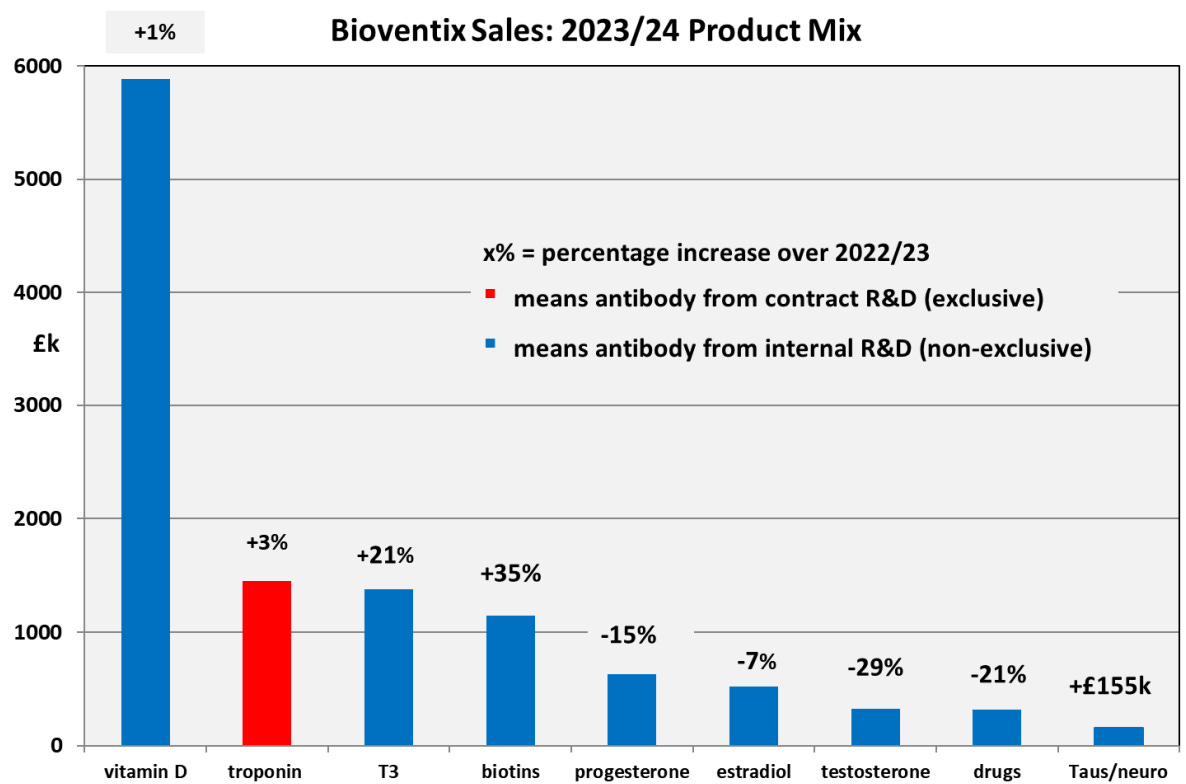

Historically, it has produced 25 different sheep monoclonal antibodies over the last 20 years, but currently, diagnostic applications are: thyroid, fertility, oncology, cardiac, vitamin D, drugs of abuse, cortisol, and B vitamins. Across these different products, revenues have broadly remained stable for most products, although there are certain standouts. Biotins (vitamin B) have risen from not contributing anything in 2020 to over 8% in 2024, while troponin (chest pain) has risen from 6% to over 10%. Meanwhile, testosterone has fallen from 4% to just over 2%. Over the last few years, vitamin D antibodies have made up over 40% of revenues, which is interesting because vitamin D deficiency is one of the most common reasons for a blood test in the Western Hemisphere due to long winters with little sunlight.

Geographical exposure:

Over the last 5 years, the UK’s contribution has fallen from 8% to 3%, while the Rest of the World has risen from 80% to 86%. Perhaps the high levels of spending in the US, where most of the major diagnostic firms are based, account for this trend.

Pipeline Developments

Tau Project: Amyloid (protein) plaque builds up around nerve cells, followed by the tangling of Tau (protein) inside the nerve cells. The symptoms of neurodegeneration ensue as the nerve cells die. Historically, Alzheimer's disease (AD) therapy was perceived to be a potential goldmine, but many had tried and failed to produce anything meaningful. Recently, this has changed with new therapies developed by major pharmaceutical companies like Eli Lilly and Biogen. Currently, expensive PET scans are used to ascertain a patient's stage along the disease pathway, and it would be preferable if a more cost-effective blood test could replace them. In early 2020, Bioventix partnered with the University of Gothenburg to develop Tau antibodies to detect AD.

Industrial Biomonitoring: Antibodies can be applied to monitoring pollution. Currently, the firm has developed antibodies to detect carcinogenic exposure in petrochemical workers/firefighters, with lateral flow tests to be developed this year.

Water Quality: Substances derived from humans, such as caffeine and paracetamol, are being used as markers of sewage contamination in waterways. The idea is to create a rapid riverside test using antibodies, which would allow test results to be pooled, shared, and enable citizen testing. I could see this becoming a significant income stream if the state of the UK’s waterways is anything to go by.

Growth

Pipeline developments: The most promising of which are the Tau antibodies. Free samples were sent out to some of its IVD clients, who subsequently ordered additional supplies, which, coupled with orders from expert neurology centers, produced revenues of £155k. It’s impressive that this equates to 1% of revenue in the early stages of the research.

China: Physical antibody shipments have been increasing year on year, with sales produced via appointed distributors and direct sales. In previous years, Chinese customers have faced hefty lead times, although these have since eased, resulting in a pronounced rise in royalty income totaling £239k (=c.2%). Currently, demand for monoclonal antibodies is propelled by research and development, with the IVD market expected to grow 4.55% between 2025-29, compared to 2.55% for the US in the same timeframe. Although there are price pressures stemming from centralized purchasing organizations, coupled with threats from the onshoring phenomenon and Chinese competition in antibody production.

Continuing operations: The firm is well-run, with a management team that includes a CEO whose tenure began at the company’s founding. Clearly, they know how to turn their innovation into revenue, with a growing portfolio of SMAs and a scalable, royalty-driven business model.

Financials

Sales & Profitability: Over the last 5 years, revenues have grown at 7.9% annually, from £9.29mn to £13.6mn. Operating margins in 2024 remained broadly in line with the 5-year average at 77%, the highest of any UK-listed biotech firm. Almost 70% of revenues stream from royalties based on sales made by its IVD client companies, manufacturing costs are excluded, leaving only negligible administrative costs, which explain the high margins. Bioventix also leads in return metrics, with return on capital and equity standing at 86.7% and 67.3%—the highest of all UK-listed biotech firms.

Solvency & Liquidity: The firm’s short-term financial stability is strong, with current and quick ratios of 7.42 and 7.07, while interest cover stands at 100. Biotech is known to be a stormy industry, financially speaking, so a cash-to-revenue ratio of 44% provides some comfort to those skittish about investment in the sector. Since listing in 2014, the company has remained debt-free with a net gearing of -50%, reducing the risk attached to future capital expenditure funded by debt.

Dividends: An industry-leading yield of 5.64%, backed by a dividend streak that goes back to its initial listing, sets it apart from other biotech firms that tend to struggle for the necessary financial stability to even pay dividends. It is important to note that in recent years, dividend cover has hovered below the 1.5 level, suggesting that a dividend cut is not out of the question.

Valuation

Assumptions used:

Revenue growth: 5%

Net income margins: 62.14%

WACC: 6.56%

A DCF fair value of £36.84 represents a margin of safety of 34%, which, for me, sits comfortably between too cheap to be true and too close to fair value to be within the margin of error. I’ve tried to maintain a base-case outlook, but if valuations are your forte, I would love to hear your thoughts on my DCF calculations.

Catalysts

Rise in Troponin sales: FDA approval for a revised label claim for Siemens troponin expands its use, potentially increasing royalties. The product is used to detect heart attacks, and the regulatory change enables Siemens to extend testing to at-risk patients.

Takeover by Big Pharma or its IVD firms: This could be part of a vertical integration strategy.

Share buybacks

Risks

Overreliance on employees: Only 17 staff members, of which 11 are scientists.

Increased regulation of the medical diagnostic market: Affects their customers since Bioventix’s products aren’t heavily regulated, but the tests they're used in require approval pre-commercialization by agencies like the US Food and Drug Administration.

Regulatory changes on sheep-derived products

M&A Risk: More mergers and acquisitions activity within its customers' market could render Bioventix products obsolete due to changes in the blood testing machines.

Lack of a firm moat: The firm lacks patents and relies on its know-how, but new firms or its own customers could develop competitive antibodies.

If this post taught you something new, consider fueling the next one:

Good post. I'd move away from trying to arithmetically calculate a WACC as a 6.5% one for BVXP is definitely too low, and that's stemming from a beta of 0.5, which doesn't intuitively make too much sense. If the UK 10-year is 4.7% then I'd definitely want to be paid a risk premium well above 180bps to own a business like BVXP.

Betas can be very variable depending on time frame, frequency and index matched against. I'd shift more to an approach of "what sort of discount rate do I want to use for BVXP", and I'd probably struggle to give you an answer of less than 8% for that, particularly given it's a small cap. If we're using a WACC of 6.5% for BVXP, then imagine what rate we might be using for something like Microsoft - 3.5%? (which of course would give enormous upside there)

Eric